Initial escrow related funding costs may apply. Credit line may be reduced, or additional extensions of credit limited if certain circumstances occur.Īn early closure fee of 1% of the original line amount, maximum $500, will apply if the line is paid off and closed within the first 30 months. Interest rate and program terms are subject to change without notice. Customers in certain states are eligible to receive the preferred rate without having a U.S. The inventory shortage is especially acute at lower price points. The supply of available existing homes fell 18.2 annually to just 1.57 million homes for sale at the end of June. Home prices are rising due to high homebuying demand and low supply. Bank personal checking account is required to receive the lowest rate but is not required for loan approval. Another concern for the housing market is rising prices. Not all loan programs are available in all states for all loan amounts. A drawdown is usually quoted as the percentage between the peak and the. Loans are subject to credit approval and program guidelines. Drawdown: A drawdown is the peak-to-trough decline during a specific recorded period of an investment, fund or commodity. Interest-only repayment may be unavailable. The 5 Equity Daily Drawdown rule takes many traders by surprise especially if you started trading FTMO before My Forex Funds. Choosing an interest-only repayment may cause your monthly payment to increase, possibly substantially, once your credit line transitions into the repayment period. Home Equity Line of Credit: Repayment options may vary based on credit qualifications.

#Home equity drawdown free#

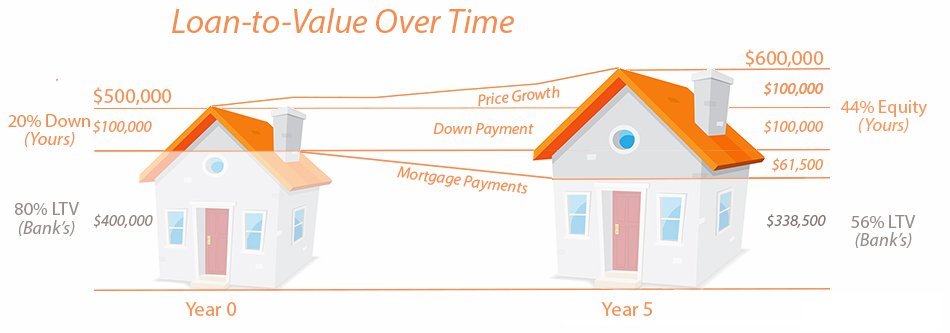

Find a financial advisor or wealth specialist Drawdown equity release mortgages (also known as drawdown lifetime mortgages) help free up a little extra cash later in life, as and when needed. In the U.S., homeowners withdrew 63 billion in equity from their properties through more than 1.

0 kommentar(er)

0 kommentar(er)